Sole Proprietorship Registration Online in Indore, Madhya Pradesh

@ Rs. 2,500*

Proprietorship Firm Registration Online within 7 working days at a low cost.

✔ Easy Process

✔ Low-Cost Application

✔ 100% Online Process

✔ 15+ Years of Experience

Why Choose Us?

Google Rating

Services Offered

Within Time

Completed Registration

What is Sole proprietorship firm?

A sole proprietorship in Indore is the simplest business structure, allowing a single person to own and operate the business without legal distinction. Sole Proprietorship Registration in Indore is easy and inexpensive, making it an attractive option for freelancers and small retail shops.

With Sole Proprietorship Registration in Indore, Madhya Pradesh, owners enjoy complete control and retain all profits but must also bear the business’s risks and liabilities.

For those considering Sole Propritorship Registration in Indore, it’s crucial to weigh the benefits against potential liabilities.

Who is eligible to register a Sole Proprietorship firm?

✔ The applicant must be an Indian citizen and a taxpayer

✔ Obtain the required licences and permits

✔ Open a bank account in the name of the firm

✔ Comply with applicable laws and regulations

✔ Fulfil industry-specific requirements

✔ Keep track of business income and expenses

Sole Proprietorship Registration Online

✔ Starting a sole proprietorship firm in India is a simple process. You can register your firm online with Avery Biz Solutions.

✔ Proprietorship firms are easy to set up and inexpensive, but the owner is personally liable for all business debts.

✔ Avery Biz Solutions can help you proprietorship firm registration online, open a bank account in the name of your business, and provide tailored solutions to help you establish and operate your business successfully.

✔ We also offer a consultation to help you determine if a sole proprietorship is the right business structure for you.

Documents required for Sole Proprietorship Registration Online in India

PAN Card

Required for shareholders and directors. Foreign nationals must provide a valid passport.

Photograph

Recent passport-size photographs of shareholders and directors.

Identity Proof

Identity proof is required such as Aadhaar Card, Voter ID, Passport, or Driving Licence.

Address Proof

Address proofs for the registered office, such as the Electricity Bill or Telephone Bill.

Business Name

Choose a unique name for the business

How does Avery Biz Solutions help you register your Proprietorship Firm Online?

Expert Guidance & Advice

Timely Completion

Tailored Assistance

Vendor Connections

Reduce registration cost

Compliance Made Easy

How to start a Sole Proprietorship Firm in India?

Obtain a PAN card

This is a unique identification number that is required for all businesses in India.

Choose a business name

Your business name must be unique and descriptive of your business.

Small and Medium Enterprise Registration / Udhyam Registration

It is not compulsory but highly recommended as it is beneficial for the company during loan requirements.

Shop and Establishment Registration

If you own a shop, this registration is mandatory for smooth and legal operation, issued by municipal authorities .

Start your Sole Proprietorship firm registration today!

Get started with a free consultation. Call Us Now

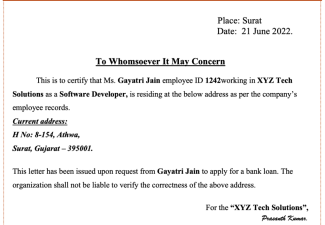

Bank account for Sole Proprietorship Registration Online

It is critical to open a bank account in the name of the business when forming a sole proprietorship. For this purpose, a current account is typically preferred because it allows for the efficient management of business transactions. To open a current account for a sole proprietorship firm, you must provide two of the following documents as proof of doing business:-

GST Registration Certificate

Shop & Establishment Act License

License from Registering Authority

Importer Exporter Code (IEC)

Advantages of Sole Proprietorship Registration Online

01.

Private Investment

Registering a Sole Proprietorship Business requires minimal investment as it is solely funded by the owner. This allows individuals to start their businesses with their own resources and retain complete ownership.

02.

Sharing of Profit and Loss

The owner of a Sole Proprietorship Business retains all the profits generated by the business. Similarly, they are solely responsible for any losses incurred. There is no need to share profits or consult with partners or shareholders.

03.

Ownership Authority

As the sole owner, you have complete control over the business. You make all decisions related to operations, strategies, and business growth without the need for consensus from others. This autonomy enables quick and efficient decision-making.

04.

Streamlined & Cost-effective Registration Process

The simplified online registration process for One Person Company (OPC) in India offers both convenience and affordability, making it an attractive option for entrepreneurs looking to establish a business with limited resources..

05.

Minimal Formalities

Sole Proprietorship Registration involves fewer formalities compared to other business structures. There are no complex legal procedures, making it easier and quicker to establish and operate the business. This reduces administrative burdens and costs.

Unique features of Sole Proprietorship Firm

Easy & Low-Cost Setup

Privacy & Confidentiality

Personal Satisfaction & Fulfillment

Direct Decision-Making

Flexibility in Operations

Tax Benefits and Deductions

Full control

Scalability

Disadvantages of Proprietorship Firm

The owner of a sole proprietorship is personally liable for all of the business’s debts and liabilities. This means that if the business fails, the owner could lose their personal assets, such as their home or car.

Sole proprietorship typically have limited access to capital. This is because they are not considered separate legal entities from the owner, which makes it more difficult for them to get loans or other forms of financing.

The owner of a sole proprietorship is responsible for all aspects of the business, including management, marketing, and accounting. This can be a lot of work for one person, and it can be difficult to find the time and expertise to do everything well.

Sole proprietorships are typically limited in their growth potential. This is because they are not able to raise capital easily, and they are not able to expand into new markets or product lines without the owner’s personal involvement.

Sole proprietorships are typically dissolved when the owner dies or retires. This means that the business does not have a long-term future and is not able to pass on to the next generation of family members.

Start your Sole Proprietorship firm registration today!

Get started with a free consultation. Call Us Now

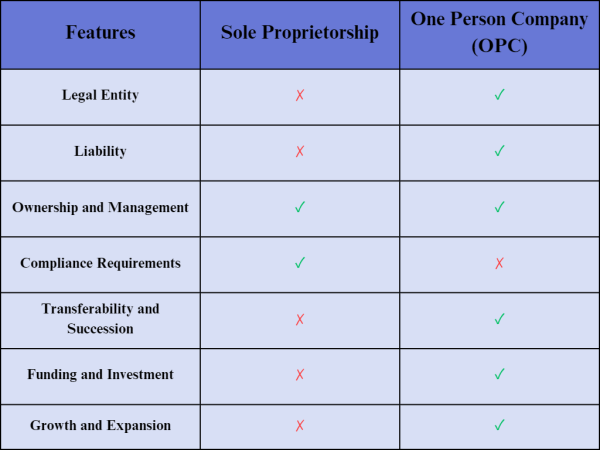

How does sole proprietorship differ from other forms of business?

Aspect | Sole Proprietorship | Partnership | Corporation |

Legal Entity | Not a separate legal entity | Not a separate legal entity | Separate legal entity |

Ownership | Sole Ownership | Shared ownership | Shared ownership |

Liability | Unlimited personal liability | Shared liability | Limited liability |

Decision-Making | Sole proprietor’s decision | Shared decision-making | Board of Directors’ decision |

Profit and Loss | Owner retains all profits and losses | Shared profits and losses | Shared profits and losses |

Taxation | Reported on owner’s personal taxes | Reported on partners’ taxes | Corporate taxes and individual taxes |

Continuity and Transferability | Dependent on the owner’s lifespan | Dependent on the partnership agreement | Continues beyond owner’s lifespan |

Compliance and Regulations | Simpler compliance requirements | Compliance with the partnership agreement | Complex regulatory compliance |

Major difference between Sole Proprietorship and One person company

It's easy, fast, and affordable to register your proprietorship with us.

Don’t delay, register your proprietorship today and start your business! Call Us Now

FAQs- Sole Proprietorship Firm Registration

A sole proprietorship is a business owned and operated by one person. The owner is responsible for all aspects of the business, including finances, taxes, and liability.

To register a sole proprietorship in India, you need to:

- File an application with the Ministry of Corporate Affairs (MCA).

- Obtain a trade license from your local municipality.

- Provide your PAN and Aadhaar details.

The registration process typically takes 10-15 days.

To start a sole proprietorship in India, you need to file an application with the Ministry of Corporate Affairs (MCA). You will also need to obtain a trade license from your local municipality.

The main advantages of sole proprietorship are:

- Ease of formation: Sole proprietorships are relatively easy to form and maintain.

- Tax benefits: Sole proprietors are taxed on their personal income, which can be beneficial if they have other sources of income.

- Flexibility: Sole proprietors have a lot of flexibility in how they run their businesses.

Yes, you can register sole proprietorship online through Avery Biz Solutions. Quick and hassle-free process.

Discover how to register a sole proprietorship easily with Avery Biz Solutions:

- Choose a business name

- Obtain necessary permits/licenses

- Register with local authorities.