Limited Liability Partnership (LLP) Registration in India

LLP Registration Fees - @ Rs. 6,500*

The Fastest & Easiest Way to Register Your Business/Startup!

✔ Easy Process

✔ Low-Cost Application

✔ 100% Online Process

✔ 15+ Years of Experience

Why Choose Us?

Google Rating

Services Offered

Within Time

Completed Registration

What is Limited Liability Partnership?

Limited partnerships and limited liability partnerships (LLPs) are business structures that offer limited liability protection. LLPs can be registered online in India, and the process involves incorporating the LLP and completing the registration.

Registering an LLP company in India requires following the LLP registration process, which can be done online. The cost of registering an LLP company in India may vary. LLP incorporation creates a separate legal entity, and LLP registration provides the benefits of limited liability. LLP firm registration can be completed online in India, following the prescribed registration process.

Essentials for Limited Liability Partnership registration

✔ Partners

A minimum of 2 partners are required for LLP formulation

✔ Digital Signature Certificates (DSC)

All partners should possess DSC to ensure the authenticity and security of electronic documents and transactions.

✔Share Capital

LLPs do not have a concept of share capital, but each partner is expected to contribute to the capital of the LLP based on agreed terms.

✔ Registered Office address

The LLP must have a registered office address in India. This address serves as the location for official correspondence.

✔ Director Identification Number (DIN)

All partners should possess DSC to ensure the authenticity and security of electronic documents and transactions.

Documents required for LLP Registration in India

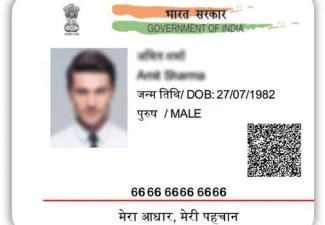

PAN Card

Required for shareholders and directors. Foreign nationals must provide a valid passport.

Photograph

Recent passport-size photographs of shareholders and directors.

Identity Proof

Identity proof is required such as Aadhaar Card, Voter ID, Passport, or Driving Licence.

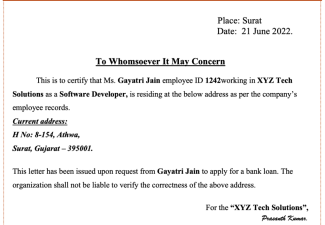

Address Proof

Documents that serve as address proof, including recent Bank Statements or utility bills

Proof of Registered Office

Documents that validate the registered office address of the LLP like Lease Agreements.

How does Avery Biz Solutions help you with LLP Company Registration?

Expert Guidance & Advice

Timely Completion

Tailored Assistance

Vendor Connections

Reduce registration cost

Compliance Made Easy

How to start/form a Limited Liability Partnership in India?

Complete LLP Registration Process

Obtain Digital Signature Certificates (DSC)

The designated partners of the LLP needs a DSC. This is a mandatory requirement for online LLP registration in India.

Apply for Director Identification Numbers (DIN)

All designated partners needs to have a DIN. It is a unique identification number for company directors.

File the LLP-RUN (Reserve Unique Name)

Reserve a unique and suitable name for your business. It is crucial to check the availability of the name.

Complete the LLP incorporation process

- File the incorporation form and required documents with the Registrar of the respective state.

- Pay the LLP registration fees as per the prescribed schedule.

- Apply for DPIN allotment for any designated partner without DIN or DPIN.

- Two individuals can jointly apply for DPIN allotment.

- Mention the approved proposed name in the registration form.

Finalise the LLP agreement

Ensure the LLP agreement is in accordance with the applicable laws and regulations.

Get started with our free consultation to learn more about LLP registration

Start your LLP today! Call Us Now

Advantages of Limited Liability Partnership In India

01.

Legal Recognition

LLPs are recognised by the law as distinct entities, which gives the company and its partners more legitimacy and protection.

02.

Capital Raising

LLPs may encourage funding from financiers and investors, facilitating company expansion and growth.

03.

Audit Requirement not Mandatory

LLPs are exempt from the requirement to conduct annual audits if their turnover falls below a predetermined threshold, lowering compliance costs.

04.

Tax Benefits

LLPs are exempt from surcharge and dividend tax, among other tax benefits, which could result in tax savings.

05.

Ease of ownership transfer

LLPs allow for simple entry and exit of partners by facilitating easy ownership transfer.

06.

Perpetual succession

LLPs have perpetual succession, which ensures that business operations continue even when partners change.

Unique features of Limited Liability Partnership

Separate legal entity

Perpetual succession

Ease of formation

Flexibility in management & ownership

Tax Benefits

Limited liability protection

How is Limited Liability Partnership(LLP) is different from others?

TYPE | PVT LTD | PARTNERSHIP | Proprietorship | LLP | OPC |

Number of Members | 2-200 | 2-20 | Max 1 | 2-unlimited | 1 |

Monitoring act | Companies act,2013 | Indian partnership act,1932 | No specific act | Limited Liability act,2008 | Companies act,2013 |

Liability of the members | Limited | Unlimited | Unlimited | Limited | Limited |

Registration | Mandatory | Optional | Not compulsory | Mandatory | Mandatory |

Level of tax rate | Moderate | High | low | High | Moderate |

Transfer of the ownership | Transferable | Non-transferable | Non-transferable | Transferable | Non-transferable |

Start your LLP today!

Our team of experts will help you every step of the way Call Us Now

FAQs- LLP Registration

A limited liability partnership (LLP) is a type of partnership in which each partner’s liability is limited to their agreed contribution to the partnership. This means that if the partnership is sued, the partners’ personal assets are not at risk.

The legal document in a limited liability partnership is called the LLP agreement. This agreement sets out the terms of the partnership, such as the partners’ contributions, their rights and responsibilities, and how the partnership will be managed.

LLP registration is the process of registering a limited liability partnership with the appropriate government agency. This process typically involves filing certain documents and paying a registration fee.

To form a limited liability partnership, you will need to:

- Choose a name for your LLP.

- File the LLP agreement with the appropriate government agency.

- Pay the registration fee.

- Open a bank account for the LLP.

- Obtain a tax identification number for the LLP.

The process of LLP registration varies depending on the country or jurisdiction in which you are registering your LLP. However, the general steps involved are as follows:

- Gather the required documents.

- Complete the registration form.

- Pay the registration fee.

- Submit the documents to the relevant government agency.

You can apply for LLP registration online or by mail. The application process typically involves submitting the following documents:

- LLP agreement

- Certificate of good standing for each partner

- Proof of identity for each partner

- Registration fee

In order to register an LLP in India, you must provide the following documents:

- PAN Card of all Partners.

- Address Proof of all Partners.

- Utility Bill of the intended Registered Office of the LLP.

- No-Objection Certificate from the Landlord.

- Copy of the Rental Agreement between the LLP and the Landlord.