Shop and Establishment Act Registration Online

@ Rs. 2000*

Apply for Shop and Establishment Registration Online with us!

✔ Easy Process

✔ Low-Cost Application

✔ 100% Online Process

✔ 15+ Years of Experience

Why Choose Us?

Google Rating

Services Offered

Within Time

Completed Registration

What is Shop and Establishment Act?

The Shop and Establishment Act governs businesses operating within the state, ensuring compliance with specific regulations. Every state has its own version of the Act, although the general provisions remain consistent across states. The Labour Department of each state is responsible for implementing the Act.

Shops, as defined under the Shop and Establishment Act, encompass premises engaged in retail or wholesale selling of goods or providing services to customers. This definition includes offices, godowns, storerooms, and warehouses connected to trade or business.

On the other hand, commercial establishments cover various activities like commercial, banking, trading, or insurance, where employees are primarily engaged in office work. Additionally, it includes hotels, restaurants, cafes, theaters, and other public entertainment venues.

Notably, factories and industries fall outside the scope of the Shop and Establishment Act and are governed by separate laws.

Registration Under The Shop and Establishment Act online

All businesses, whether physical, home-based, or online, covered by the Act must secure a Shop and Establishment Registration Certificate or Shop License from their respective state. This essential registration must be completed within 30 days of starting operations.

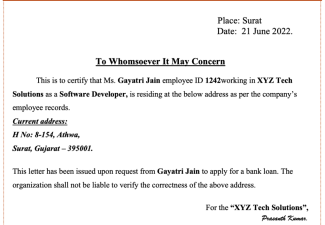

The Shop and Establishment Registration Certificate serves as a fundamental document, facilitating the acquisition of other licenses and registrations. It acts as proof of incorporation, enabling businesses to obtain loans and open current bank accounts.

Ensure hassle-free Shop and Establishment Act Registration online with Avery Biz Solutions. Contact us now for expert assistance in securing your business’s compliance and growth

Documents Required for Shop and Establishment Registration

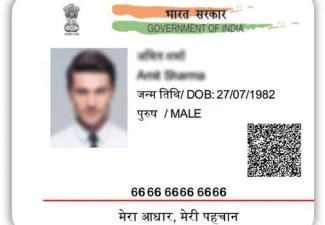

PAN Card

Pan Card of the proprietor is required

Address Proof

Provide address proofs for the registered shop, such as the latest Electricity Bill or Telephone Bill.

Identity Proof

Identity proof is required i.e. Aadhaar Card or Voter ID and Driving Lisence. A copy of all of them.

Information Required for Shop and Establishment Registration

Details of Employees.

Payment Challan.

Business licenses, if applicable.

Registration under shops and establishment act today!

Get your Shop and Establishment Registration with a free consultation. Call Us Now

Shop and Establishment License Procedure with Avery Biz Solutions

Contact our expert

Upload document on Vault

Filing of License Application

Receipt of Shop License

Regulations Under The Shop and Establishment Act in India

The Shop and Establishment Act encompasses various regulations to ensure a fair and conducive working environment. Some of the key areas it regulates include:

✔ Working Hours, Leave, and Holidays: Guidelines for Daily and Weekly Hours, Leave, and Holidays.

✔ Payment of Wages and Compensation: Fair Payment of Wages and Compensation Policies.

✔ Prohibition of Child Labor: Strict Prohibition of Child Labor.

✔ Night Shift Restrictions: Limitations on Employment of Women and Young Persons during Night Shifts.

✔ Enforcement and Inspection: Empowering Authorities for Enforcement and Inspection.

✔ Rest Intervals: Mandated Rest Intervals during Working Hours.

✔ Opening and Closing Hours: Specified Operating Hours.

✔ Record Keeping: Requirements for Employee Record Keeping.

✔ Dismissal Guidelines: Fair Employee Dismissal Procedures.

At Avery Biz Solutions, we guide businesses through these Shop and Establishment Act regulations to foster a harmonious work environment. Reach out to us for expert support in ensuring compliance with the Act.

Shop and Establishment License Procedure

Visit the official website of the respective state’s Labour Department and create a user ID and password.

Fill in essential details, including the proposed establishment/shop’s name, employer’s information, employee details, registered address, and PAN card details.

Access the Shop and Establishment Registration Form A and provide the necessary information, including the state and district of the establishment.

Upload the required documents as per the guidelines provided on the website.

Make the necessary payment for processing the application.

Track the application status through the designated “under-scrutiny” option

Upon successful verification of documents and compliance with legal requirements, the Shop and Establishment License will be issued for the proposed establishment/shop.

In the case of physical form submission, the processing time for verification and license issuance may take around 15-20 working days in major city areas, subject to variation based on the state’s procedures. However, the online process typically ensures faster and smoother registration.

Who is eligible for Shop and Establishment License in India?

✔ Wholesalers or the retailer’s shops and establishments

✔ Service Centres

✔ Warehouses, Storerooms, and go-downs

✔ Additionally, any other working places

✔ Hotels

✔ Eateries and restaurants

✔ Entertainment houses, Amusement parks, Theatres, etc.

Penalties under the Shop and Establishment Act

Late Registration Fine

Employers late to register may incur fines of ₹100-₹1,000 varying by state regulations.

Non-Maintenance of Registers Fine

Neglecting mandatory registers eg.- attendance, wage may lead to fines of ₹100 – ₹1,000.

Working Hour Regulations Fine

Non-compliance with prescribed working hour regulations may lead to fines varying by state.

Leave Policies Non-Compliance Fine

Failure to comply with minimum leave entitlements may result in fines varying by state.

Non-Payment of Wages Fine

Not paying employees within the prescribed time limit may lead to fines varying by state.

Registration Cancellation

Extreme non-compliance can result in the cancellation of establishment registration, leading to business closure.

How Avery Biz Solutions will help you with Shop and Establishment Registration?

Expert Assistance

Legal Expertise

Effective Solutions

One-Stop Solution

Timely Response

Transparent Process

Register for your Shop and Establishment License Today!

Get started with the Shop and Establishment act Registration. Call Us Now

What is Shop and Establishment act License?

The Certificate or Shop and establishment act License serves as the foundational business registration/license, with broader implications. It serves as a cornerstone for acquiring diverse business licenses and registrations. This document (Shop License) substantiates the legal status of commercial establishments or shops.

Furthermore, it proves invaluable for entrepreneurs seeking loans or establishing dedicated business bank accounts. Notably, many banks require this Shop Certificate as a prerequisite when initiating the process of opening a current bank account, highlighting its indispensable role in both regulatory compliance and financial transactions.

Benefits of Shop and Establishment License

01.

Legal Recognition

Obtaining a valid Shop and Establishment License provides legal recognition to your business, enhancing its credibility and trustworthiness among customers and suppliers.

02.

Compliance with the Law

The license ensures that your business is compliant with the Shop and Establishment Act, avoiding potential penalties and legal issues.

03.

Access to Government Schemes

Registered businesses can access various government schemes, incentives, and benefits, supporting their growth and development.

04.

Social Security Benefits

The license allows employees to avail of social security benefits, fostering a positive work environment and employee satisfaction.

05.

Seamless Business Operations

The license serves as a foundation for acquiring other licenses and registrations, streamlining business operations.

06.

Opening Bank Accounts

Banks often require the license for opening business bank accounts, facilitating financial transactions.

Reason behind Introducing the Shop and Establishment Act License

- The Shop and Establishment Act License was introduced to regulate and oversee the functioning of shops and commercial establishments.

- Its primary purpose is to ensure businesses comply with specific rules and regulations, promoting fair labour practices.

- The license safeguards the rights of employees, providing them with adequate rest intervals, annual leave, and weekly holidays.

- Obtaining the Shop and establishment Act License is essential for businesses to operate legally and gain credibility in the market.

- Compliance with the license demonstrates responsible business practices, fostering trust and confidence among customers and employees.

Closure of Shop or Establishment

Businesses may choose to voluntarily close their shop or establishment for various reasons, such as retirement, business restructuring, or relocation.

Before closure, businesses must fulfill legal formalities, including notifying authorities, settling employee dues, and complying with statutory requirements.

Employers need to settle pending salaries, gratuity, and other dues for their employees as per labor laws

Closure necessitates adhering to the Shop and Establishment Act’s guidelines and fulfilling tax obligations

Authorities must be informed about the closure, and appropriate documentation should be submitted.

Relevant licenses and permits should be cancelled or surrendered as required by law.

Register for Shop and Establishment today!

Let us take care of the legal work so you can focus on your business. Call Us Now