Partnership Firm Registration Online In Indore, Madhya Pradesh

@ Rs. 5,000*

The Fastest & Easiest Way to Register Your Business/Startup Online!

✔ Easy Process

✔ Low-Cost Application

✔ 100% Online Process

✔ 15+ Years of Experience

Why Choose Us?

Google Rating

Services Offered

Within Time

Completed Registration

Overview of Partnership Firm Registration in Indore

Partnership Registration in Indore provides key legal benefits and advantages to the entrepreneur. While not mandatory, it is highly recommended to take advantage of the benefits of a registered Partnership firm in Indore, Madhya Pradesh.

Registering a partnership in Indore involves drafting a Partnership Deed, outlining partners’ rights and profit-sharing. The Partnership Act, 1932, governs partnership registration in Indore.By registering the partnership firm in Indore, firms gain credibility, legal recognition, and access to business transactions, bank accounts, and government benefits.

Partnership registration firm online in Indore, Madhya Pradesh simplifies the process, allowing businesses to focus on growth in a competitive market and excel.

Essentials for Partnership Firm Registration in Indore

✔ Partners

A minimum of 2 partners are required to form a partnership.

✔ Partnership Deed

A partnership deed is a legal document outlining the terms and conditions of the partnership, as well as the rights, obligations, and responsibilities of each partner, as well as the profit-sharing percentage and capital contributions.

✔ Partner Information

Full information about each partner may be required, including their names, addresses, PANs (Permanent Account Numbers), and pictures.

✔ Bank Account

Opening a separate bank account in the name of the partnership firm is essential for managing business transactions in Partnership.

✔ Registration Fees

In order to register a partnership, the prescribed registration fees must be paid. The fees may vary depending on the state or jurisdiction where the partnership is registered.

✔ Consent of Partners

All partners must provide their consent to become part of the partnership firm and be willing to abide by the terms and conditions mentioned in the Partnership Deed.

✔ Stamp Duty

Payment of stamp duty may be required for executing the Partnership Deed. The amount of stamp duty varies based on the state where the partnership is registered.

✔ Partnership Firm Name

The partnership firm should have a unique name that is not already taken or confusingly similar to one already used by another company. It is a good idea to check the availability of a name before deciding on the partnership firm name.

Documents Required for Partnership Registration in Indore

Partnership Deed

A Partnership Deed is a legal document that outlines the terms and conditions of the partnership, including the rights, duties, and responsibilities of each partner, profit-sharing ratio, and capital contributions.

Passport-size photograph

Recent passport-size photographs of all partners are required.

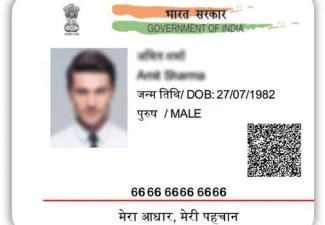

Identity Proof

Identity proof documents, such as Aadhaar Card, Passport, or Driver's License, need to be submitted for all partners.

Address Proof

Address proof documents, such as Aadhaar Card, Voter ID, Passport, or utility bills, need to be submitted for all partners.

PAN Cards

PAN (Permanent Account Number) cards of all partners are required for partnership registration.

Partnership Firm Name

The chosen name for the partnership firm should be provided along with an undertaking stating that the name is unique and not in use by any other business entity.

Registered Office Proof

Proof of the registered office address, such as rent agreement, utility bill, or property ownership documents, needs to be submitted.

Partnership Firm Application Form

The prescribed application form for partnership registration, duly filled and signed by all partners, should be submitted.

Other Additional Documents

Depending on the state or jurisdiction, additional documents or forms may be required, such as Form 1 (Application for Partnership Firm Registration), affidavits, consent letters, or declaration forms.

Are you looking to register your partnership firm?

We can help! Our team of experts will guide you through the entire process, from filing the paperwork to obtaining your registration certificate.

Procedure of Registration of Partnership Firm in Indore

Choose a Distinctive Name for Your Partnership Firm

Select a unique and memorable name for your partnership firm that sets it apart from others in the industry.

Complete the Application for Partnership Firm Registration

Fill out the Form 1 application for partnership registration in the prescribed format. Ensure that all required details are provided accurately for the registration of the partnership firm.

Submit the Filled Application to the Registrar of the Firm

Send the completed application form along with the necessary documents and the specified fee to the Registrar of the Firm in your state. Adhere to the guidelines and procedures set by the registrar.

Forming a Comprehensive Partnership Deed

Create a well-planned and properly drafted Partnership Deed with the consent of all partners. Include essential components such as partner information, business nature, capital contributions, profit sharing, rights and duties, loan details, retirement procedures, and any other mutually agreed articles.

Submit Required Documents for Partnership Registration

Along with the Partnership Deed, submit all the necessary documents for partnership registration. These may include partner details, qualifications, addresses, capital contribution proofs, and any other supporting documents as per the registrar’s requirements.

Document Verification and Registration

The submitted documents, including the Partnership Deed, will be thoroughly verified by the relevant authorities. If all provisions of the law are met, and the documents are in order, the partnership firm will be granted the registration certificate.

Types of partners in a Partnership firm in Indore

An active partner is one who actively participates in the management and operation of the partnership company. They are in charge of making decisions, managing day-to-day tasks, and representing the company externally.

A partner who does not take part in the daily management of the partnership firm is known as a sleeping partner. They typically contribute financial resources to the company, but they are powerless to influence how it is run.

A nominal partner is a partner who is merely listed on the partnership deed and makes no actual capital contributions or managerial contributions to the company. They are typically used to give the impression that the firm is more financially sound than it actually is.

A partner who contributes no capital to the company but only receives a share of the profits is known as a partner in profits only. They do not have any liability for the firm’s debts.

A person who has represented themselves as a partner is said to be a partner by estoppel even though they are not actually a partner in the company. This can happen if they use the firm’s name or if they represent themselves as partners to third parties.

A person under the age of 18 is considered a minor partner. The amount of capital they contribute to the firm determines how much liability they have as partners.

A partner who is hidden from the public is referred to as a secret partner. Despite being involved in the company’s management, they do not want their participation to be made public.

Advantages of Becoming a Partnership Firm in Indore

Legal Recognition

Registration gives the partnership firm legal status and establishes its distinct identity from the partners. It increases the credibility and trust of company partners, lenders, and clients.

Partnership Deed Protection

The partnership deed, which outlines the terms and conditions of the partnership, becomes a legally enforceable document once the firm is registered. This helps in resolving disputes and protecting the rights of partners.

Easy Business Operations

Registered partnership firms are eligible for a number of government perks and facilities, conducting business is made simple for them. They can more easily generate bank accounts, ask for loans, sign contracts, and carry out business activities.

Access to Funding

Partnership firms that are registered have easier access to finance and financial support from banks, financial institutions, and government programs. They have the option of raising funds through investments, borrowings, or equity contributions.

Tax Benefits

Partnership businesses are taxed at a lower rate than corporations. To avoid the double taxation that businesses must pay, the firm’s profits are taxed at the level of each individual partner. According to the Income Tax Act, partners are also eligible for tax breaks and perks.

Limited Compliance

Partnership firms have comparatively fewer compliance requirements compared to companies. They are exempt from certain legal formalities, such as conducting annual general meetings and filing audited financial statements.

Start your partnership firm in Indore today with our easy-to-use online registration process.

We’ll help you with all the paperwork and fees, so you can focus on running your business.

Disadvantages of becoming a Partnership Firm in Indore

Partnerships expose partners to unlimited liability, risking personal assets if the business faces financial or legal issues. This financial risk can deter potential partners and put significant strain on individuals.

Equal decision-making authority in partnerships can lead to conflicts and impede progress. Varying opinions and preferences among partners make reaching a consensus challenging, potentially hindering effective business operations.

Dissolving a partnership is a time-consuming and complex process, particularly when partners have irreconcilable differences or wish to retire. Legal procedures, debt settlement, asset distribution, and termination of operations can disrupt business continuity and create financial and emotional challenges.

Partnerships may struggle to raise capital and access resources compared to corporations. Limited external investment and reliance on partners’ capital contributions restrict growth opportunities, potentially hindering the partnership’s expansion and development.

Comparison Table

TYPE | PVT LTD | PARTNERSHIP | Proprietorship | LLP | ONE PERSON COMPANY |

Number of Members | 2-200 | 2-20 | Max 1 | 2-unlimited | 1 |

Monitoring act | Companies act ,2013 | Indian partnership Act, 1932 | No specific act | Limited Liability act,2008 | Companies act,2013 |

Liability of the members | Limited | Unlimited | Unlimited | Limited | Limited |

Registration | Mandatory | Optional | Not compulsory | Mandatory | Mandatory |

Level of tax rate | Moderate | High | low | High | Moderate |

Transfer of the ownership | Transferable | Non-transferable | Non-transferable | Transferable | Non-transferable |

Major differences between Limited Liability Partnership and Partnership

Aspect | Limited Liability Partnership | Partnership |

Liability | Limited Liability | Unlimited Liability |

Legal Entity | Separate Legal Entity | No Separate Legal Entity |

Registration | Mandatory Registration | Optional Registration |

Minimum Partners | Minimum 2 designated partners | Minimum 2 Partners |

Perpetual Succession | Yes | No |

Management | Designated Partners | Equal Management |

Compliance Requirements | More stringent | Fewer Requirements |

FAQs for Online Registration of Partnership Firm

A partnership firm is a business owned and operated by two or more people who share the profits and liabilities of the business.

A partnership deed is a legal document that outlines the terms and conditions of a partnership between two or more people. It typically includes information about the profit and loss sharing ratio, the management structure, and the procedures for dissolving the partnership.

The partnership firm registration fees in India range from ₹2,499 to ₹10,999, depending on the state in which the firm is registered. The fees typically include government charges, professional fees, and stamp duty.

Here are the documents required for a partnership deed:

- PAN card of each partner

- Address proof of each partner

- Partnership deed signed by all partners

- PAN of the firm

- Address proof of the firm

- Affidavit of acknowledgement with all details and attested by the notary

- Photographs of all partners

Registering a partnership firm in India is a simple process that can be completed in 1-2 weeks. Avery Biz Solutions can help you with every step of the process, from choosing a name for your firm to filing the application with the Registrar of Firms. We will also help you with the required documentation and fees.

The maximum number of partners in a partnership firm in India is 50. This is as per Rule 10 of the Companies (Miscellaneous) Rules, 2014. The minimum number of partners required to form a partnership firm is 2.

No, registration of a partnership firm is not compulsory in India. However, there are some benefits to registering a partnership firm, such as the ability to sue and be sued in the firm’s name, and the ability to obtain a loan from a bank in the firm’s name.